What is the average credit score for a mortgage in Ontario?: Getting mortgage approval in Ontario can be stressful. Anyone aspiring to own property must not only obtain authorization for a mortgage but also comply with ever-stricter mortgage approval requirements because housing costs are rising across most of the country annually.

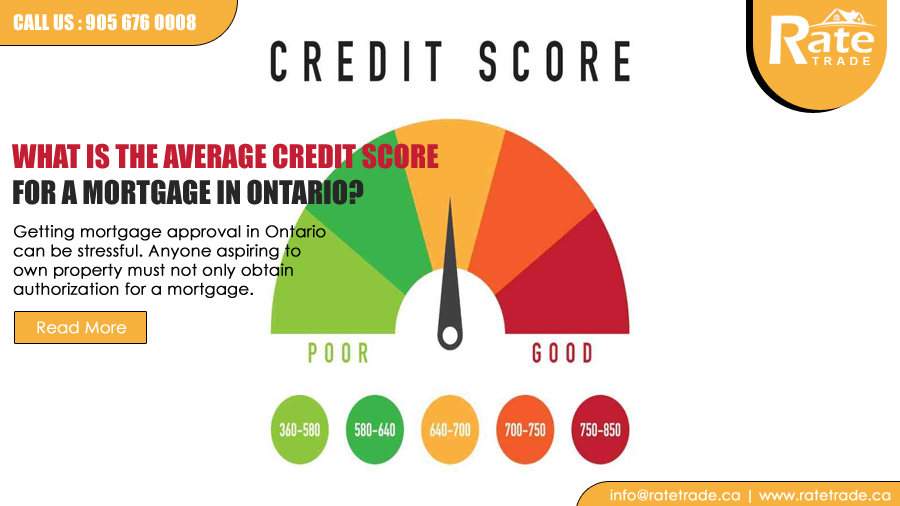

Your credit score is one of the essential elements in determining whether or not a lender would accept you for a mortgage. A credit bureau determines your credit score between 0 and 900 by estimating how likely you are to make timely payments on your debts. Lenders will view you as more reliable if your credit score improves.

What credit score must I have to get the best mortgage rates?

You can qualify for better rates the higher your credit score.

● A total of 741: You have an excellent credit rating; here, you may find the most competitive mortgage rates.

● Your credit score is between 713 and 740. Several possibilities are available to you, and you should get a perfect interest rate.

● Lenders view a credit score of 660 to 712 as fair. The standard credit score range, however, begins once you reach 660.

● Banks and lenders consider a credit score between 575 and 659 below average. Obtaining a conventional mortgage from a bank or online lender may be challenging if your credit score is lower than 640. Before making a mortgage application, think about working to raise your credit score.

● Having a credit score between 300 and 574 indicates that you should work on improving it. You are currently a high-risk borrower, given the state of your credit. You would have to pay extraordinarily high-interest rates if your mortgage application were accepted. It would help if you worked to raise your credit score to obtain better mortgage rates in the future.

Mortgage rates and credit scores: do they affect each other?

When you apply for a mortgage, your ability to access specific rates will be directly influenced by your credit score. With the help of these ratings, lenders can see what kind of borrower you are and how you handle your money.

This, in turn, enables the lender to assess your level of risk as a borrower and determine whether they will need to raise their rates to reflect that risk.

What Do Lenders Look For in Mortgage Applications from Home Buyers?

Lenders will consider more than just your credit score when considering your application for a mortgage. They’ll also be interested in your debt management skills and payment history. This implies that they will obtain a copy of your credit report, so even if you have the required minimum credit score.

Warning signs in this report may play a role in whether or not you approved for a loan. You should know what mortgage lenders will be looking for to be well prepared for your mortgage application procedure. They will likely examine:

1- Your income

2- The history of your employment

3- Your everyday costs

4- The sum you intend to borrow

5- Your current obligations

6- Amortization timeframe

7- Monthly housing expenses related to your new residence (mortgage payment, potential property taxes, potential utility bills, condo fees, etc.)

The mortgage rates you can get and the time it takes to approved heavily depend on your credit score. You should familiarize yourself with your credit score if you haven’t before. Also before looking for preapprovals, spend some time repairing and raising your credit score.

So that you may be sure you’re obtaining the lowest prices. This is especially important if you have the opportunity to put off purchasing a home shortly.

Comments (0):