100 Mile House 108 Mile House 108 Mile Ranch 150 Mile House Abbey Abbotsford Aberarder Abercorn Aberdeen Abernethy Abitibi Canyon Acadia Valley Acme Acton Acton Vale Adamsville Adolphustown Advocate Harbour Agassiz Agassiz Provincial Forest Aguanish Ahousat Ailsa Craig Airdrie Ajax Aklavik Alameda Alban Albanel Albert Albert Mines Alberta Beach Alberton Alder Flats Aldergrove Alderville First Nation Alert Bay Alexander Alexandria Alexis Creek Alfred Algoma Mills Alida Alix Alkali Lake Allan Allardville Alliance Alliston Alma Alma Almonte Alonsa Alouette Alsask Altario Altona Alvena Alvinston Amherst Amherstburg Amos Amqui Ancaster Andrew Aneroid Angliers Angus Anjou Annapolis Royal Anse-Saint-Jean Antigonish Anzac Appleton Apsley Arborfield Arborg Archerwill Arcola Arden Ardrossan Argentia Argyle Arichat Arkell Arkona Armagh Armstrong Armstrong Arnolds Cove Arnprior Arrowwood Arthur Arundel Arviat Asbestos Ascot Ascot Corner Ashcroft Ashern Ashmont Ashuapmushuan Asquith Assiniboia Assumption Aston-Jonction Athabasca Athens Atikokan Atlin Attawapiskat Atwood Auburn Aurora Austin Avola Avondale Avonlea Avonmore Ayers Cliff Aylesford Aylmer Aylmer Ayr Ayton Azilda Baddeck Baden Badger Bagotville Baie Verte Baie-Comeau Baie-de-Shawinigan Baie-des-Sables Baie-du-Febvre Baie-durfe Baie-Johan-Beetz Baie-Sainte-Catherine Baie-St-Paul Baie-Ste-Anne Baie-Trinite Bailieboro Baker Brook Baker Lake Bala Balcarres Baldur Balfour Balgonie Balmertown Balmoral Baltimore Bamfield Bancroft Banff Barachois Barkmere Barons Barraute Barrhead Barrie Barriere Barrys Bay Barwick Bashaw Bass River Bassano Basswood Batawa Batchawana Bay Bath Bath Bathurst Batiscan Batteau Battle Harbour Battleford Bauline Bawlf Bay Bulls Bay de Verde Bay L`Argent Bay Roberts Bayfield Baysville Beach Grove Beachburg Beachville Beaconsfield Beamsville Bear Canyon Bear Lake Bear River Beardmore Bearskin Lake Bearskin Lake First Nation Bear`s Passage Beaucanton Beauceville Beauharnois Beaulac-Garthby Beaumont Beaumont Beaumont Beauport Beaupre Beausejour Beauval Beaver Cove Beaver Creek Beaverdell Beaverlodge Beaverton Becancour Bedeque Bedford Beechy Beeton Beiseker Bell Island Bella Bella Bella Coola Belle Neige Belle River Belledune Bellefeuille Belleoram Belleterre Belleville Bellevue Belmont Belmont Beloeil Bengough Benito Benoit`s Cove Bentley Berens River Beresford Bergeronnes Berthierville Berwick Berwyn Bethany Bethesda Bethune Betsiamites Beulah Biencourt Bienfait Big River Big Trout Lake Big Valley Biggar Binbrook Bindloss Binscarth Birch Hills Birch Island Birchy Bay Birsay Birtle Biscotasing Bishopton Bishop`s Falls Bissett Black Creek Black Diamond Black Duck Cove Black Lake Black Point Black Tickle Blackfalds Blackie Blacks Harbour Blackstock Blackville Blaine Lake Blainville Blanc-Sablon Blandford Blenheim Blezard Valley Blind River Bloomfield Blue Ridge Blue River Blyth Bob Quinn Lake Bobcaygeon Boiestown Bois-des-Filion Boisbriand Boischatel Boisdale Boissevain Bolton Bon Accord Bonanza Bonaventure Bonavista Bonfield Bonne-Esperance Bonnyville Borden Borden Borden Boston Bar Boswell Bothwell Botwood Boucherville Bouchette Bouctouche Boularderie Bourget Bow Island Bowden Bowen Island Bowmanville Bowser Boyd`s Cove Boyle Bracebridge Bradford Bradford West Gwillimbury Braeside Bragg Creek

Brampton Branch Brandon Brantford Breakeyville Brechin Bredenbury Brent`s Cove Breslau Breton Bridge Lake Bridgenorth Bridgetown Bridgewater Briercrest Brigden Brigham Bright Brighton Brights Grove Brigus Britannia Beach Britt Broadview Brochet Brock Brocket Brockville Brome Bromont Bromptonville Brookdale Brookfield Brooklin Brooks Brossard Browns Flat Brownsburg Brownsville Brownvale Bruce Mines Bruderheim Bruno Brussels Bryson Buchanan Buchans Buckhorn Buckingham Buffalo Narrows Burdett Burford Burgeo Burgessville Burin Burk`s Falls Burleigh Falls Burlington Burnaby Burns Lake Burnt Islands Burstall Burwash Landing Bury Byemoor Cabano Cabri Cache Bay Cache Creek Cacouna Cadillac Cadillac Cadomin Calabogie Calder Caledon Caledon East Caledonia Calgary Callander Calling Lake Calmar Calstock Calumet Cambray Cambridge Cambridge Bay Cameron Camlachie Campbell River Campbellford Campbellton Campbellton Campbellville Campbell`s Bay Camperville Campobello Island Camrose Canal Flats Candiac Canmore Canning Cannington Canoe Narrows Canora Canso Canterbury Cantley Canwood Cap-a-l`Aigle Cap-aux-Meules Cap-Chat Cap-de-la-Madeleine Cap-des-Rosiers Cap-Pele Cap-Rouge Cap-Saint-Ignace Cape Broyle Cape Dorset Caplan Capreol Caradoc First Nation Caramat Caraquet Carberry Carbon Carbonear Carcross Cardiff Cardigan Cardinal Cardston Cargill Caribou Carievale Carignan Carillon Carleton Carleton Carleton Place Carlyle Carmacks Carman Carmangay Carmanville Carnarvon Carnduff Caroline Caron Carp Carrot River Carseland Carstairs Cartier Cartwright Cartwright Casselman Cassiar Castlegar Castlemore Castleton Castor Cat Lake Catalina Causapscal Cavan Cayley Cayuga Celista Central Butte Centralia Centreville Centreville-Wareham-Trinity Cereal Cessford Ceylon Chalk River Chambly Chambord Champion Champlain Chance Cove Chandler Change islands Chapais Chapeau Chapel Arm Chapleau Chaplin Charette Charlemagne Charlesbourg Charlevoix Charlottetown Charlottetown Charlton Charny Chartierville Chase Chateau-Richer Chateauguay Chatham Chatham-Kent Chatsworth Chauvin Chelmsford Chelsea Chelsea Chemainus Cheneville Chesley Chester Chesterfield Inlet Chestermere Chesterville Chesterville Cheticamp Chetwynd Cheverie Chevery Chibougamau Chicoutimi Chiefs Point First Nation Chilliwack Chipewyan Lake Chipman Chipman Chippewas of Kettle/Stony Poin Chippewas Of Sarnia First Nati Chisasibi Choiceland Chomedey Christian Island Christina Lake Christopher Lake Churchbridge Churchill Churchill Falls Chute-aux-Outardes Chute-des-Passes Clair Clairmont Claremont Clarence Creek Clarence-Rockland Clarenville Clarenville-Shoal Harbour Claresholm Clarington Clarke`s Beach Clarks Corners Clarkson Clarksville Clark`s Harbour Clavet Clearwater Clearwater Bay Clericy Clermont Clifford Climax Clinton Clinton Clive Cloridorme Cloud Bay Clova Clyde Coaldale Coalhurst Coaticook Cobalt Cobble Hill Cobden Coboconk Cobourg Cocagne Cochenour Cochin Cochrane Cochrane Coderre Codroy Coe Hill Colborne Colchester Cold Lake Cold Springs Coldwater Coleville Colliers Collingwood Collingwood Corner Colombier Colonsay Colwood Comber Come By Chance Comfort Cove-Newstead Comox Compton Conception Bay South Conception Harbour Conche Concord Coniston Conklin Connaught Conne River Conquest Consort Constance Bay Constance Lake First Nation Consul Contrecoeur Cookshire Cookstown Cooksville Cook`s Harbour Coquitlam Coral Harbour Cormorant Corner Brook Cornwall Coronach Coronation Corunna Cote-St-Luc Coteau-du-Lac Cottam Cottlesville Courcelette Courcelles Courtenay Courtice Courtright Coutts Covehead Cow Head Cowan Cowansville Cowichan Bay Cowley Crabtree Craigmyle Craik Cranberry Portage Cranbrook Crandall Crapaud Crawford Bay Crediton Creelman Creemore Creighton Cremona Crescent Beach Creston Cross Lake Crossfield Crowsnest Pass Crysler Crystal Beach Crystal City Cudworth Cumberland Cumberland Cumberland House Cupar Cupids Cut Knife Cypress River Czar Dalhousie Dalmeny Daniel`s Harbour Danville Darlingford Dartmouth Dashwood Dauphin Daveluyville Davidson Davis Inlet Dawson Dawson Creek Daysland Dease Lake Deauville Debden Debec Debert DeBolt Deep River Deer Lake Deer Lake Deerbrook Degelis Delaware of the Thames(Moravia Delburne Delhi Delia Delisle Delisle Deloraine Delson Delta Delta Denbigh Denzil Derwent Desbarats Desbiens Deschaillons-sur-Saint-Laurent Deseronto Destruction Bay Deux-Montagnes Deux-Rivieres Devlin Devon Dewberry Didsbury Dieppe Digby Dillon Dingwall Dinsmore Disraeli Dixonville Doaktown Dodsland Dokis Dokis First Nation Dolbeau-Mistassini Dollard-des-Ormeaux Dominion City Domremy Donald Donalda Donnacona Donnelly Dorchester Dorchester Dorion Dorset Dorval Douglas Douglas Lake Douglastown Dover Drake Drayton Drayton Valley Dresden Drumbo Drumheller Drummondville Dryden Dublin Dubreuilville Dubuc Dubuisson Duchess Duck Lake Dugald Duncan Dunchurch Dundalk Dundas Dundee Dundurn Dungannon Dunham Dunnville Dunsford Dunster Duparquet Dupuy Durham Dutton Duvernay Dwight Dyer`s Bay Dysart D`Arcy Eagle Lake First Nation Eagle River Eaglesham Ear Falls Earl Grey Earlton East Angus East Bay East Broughton East Coulee East Farnham East Gwillimbury East Hereford East Pine East Point East York Eastend Easterville Eastmain Eastman Eastport Eastwood Eatonia Echo Bay Eckville Ecum Secum Edam Eddystone Edgerton Edmonton Edmundston Edson Edwin Edzo Eganville Elbow Eldon Elfros Elgin Elgin Elie Elizabethtown Elk Lake Elk Point Elkford Elkhorn Elko Elkwater Elliot Lake Elliston Elm Creek Elmira Elmsdale Elmvale Elnora Elora Elrose Embree Embro Embrun Emerson Emeryville Emo Empress Emsdale Enchant Enderby Englee Englehart English Harbour East Enterprise Enterprise Entrelacs Erickson Eriksdale Erin Eskasoni Espanola Essex Estaire Esterel Esterhazy Estevan Estevan Point Eston Ethelbert Etobicoke Etzikom Eugenia Evain Evansburg Exeter Exshaw Eyebrow Fabre Fabreville Fair Haven Fairmont Hot Springs Fairview Falardeau Falcon Lake Falher Falkland Farnham Faro Fassett Fauquier Fauquier Faust Fenelon Falls Fenwick Fergus Ferintosh Ferland Ferme-Neuve Fermeuse Fermont Fernie Feversham Field Field Fillmore Finch Fingal Fisher Branch Fisher River Fisherville Flamborough Flanders Flatbush Flatrock Flatrock Fleming Flesherton Fleur de Lys Fleurimont Flin Flon Florenceville Flower`s Cove Foam Lake Fogo Foley Foleyet Fond-du-Lac Fords Mills Foremost Forest Forest Grove Forestburg Forestville Fork River Fort Albany Fort Assiniboine Fort Chipewyan Fort Erie Fort Frances Fort Fraser Fort Good Hope Fort Hope Fort Liard Fort MacKay Fort Macleod Fort McMurray Fort McPherson Fort Nelson Fort Providence Fort Qu`Appelle Fort Saskatchewan Fort Severn Fort Severn First Nation Fort Simpson Fort Smith Fort St. James Fort St. John Fort Vermilion Fort William First Nation Fort-Coulonge Forteau Fortierville Fortune Fossambault-sur-le-Lac Fox Cove-Mortier Fox Creek Fox Lake Fox Valley Foxboro Foxwarren Foymount Frampton Francis Frankford Franklin Centre Fraser Lake Fredericton Fredericton Junction Freelton Freeport Frelighsburg French River First Nation French Village Frenchmans Island Freshwater Frobisher Frontier Fruitvale Fugereville Gabarus Gabriola Gadsby Gagetown Gainsborough Galahad Galiano Island Galt Gambo Gananoque Gander Ganges Garden Hill Garden River First Nation Garnish Garson Gaspe Gatineau Gaultois Gentilly Georgetown Georgetown Georgina Geraldton Gibbons Gibsons Gift Lake Gilbert Plains Gillam Gilmour Gimli Girardville Girouxville Giscome Gjoa Haven Glace Bay Gladstone Glaslyn Glassville Gleichen Glen Ewen Glen Robertson Glen Water Glen Williams Glenavon Glenboro Glencoe Glendon Glenella Glenwood Glenwood Gloucester Glovertown Godbout Goderich Gods Lake Narrows Gogama Gold Bridge Gold River Goldboro Golden Golden Lake Good Hope Lake Gooderham Goodeve Goodsoil Goose Bay Gore Bay Gormley Gorrie Goshen Goulais River Govan Gowganda Gracefield Grafton Granby Grand Bank Grand Bay Grand Beach Grand Bend Grand Centre Grand Etang Grand Falls Grand Falls Grand Falls-Windsor Grand Forks Grand Lake Grand Manan Grand Narrows Grand Rapids Grand Valley Grand-Mere Grand-Remous Grand-Sault Grande Cache Grande Prairie Grande-Anse Grande-Entree Grande-Riviere Grande-Vallee Grandes-Bergeronnes Grandes-Piles Grandview Granisle Granton Granum Grasmere Grassland Grassy Lake Grassy Narrows Grassy Narrows First Nation Grassy Plains Gravelbourg Gravenhurst Grayson Great Harbour Deep Great Village Green Island Cove Green Lake Greenfield Park Greenspond Greensville Greenville Greenwood Greenwood Grenfell Grenville Gretna Grimsby Grimshaw Grouard Guelph Guigues Gull Bay Gull Bay First Nation Gull Lake Guysborough Gypsumville Hadashville Hafford Hagersville Hague Haileybury Haines Junction Hairy Hill Haldimand Haliburton Halifax Halkirk Halton Hills Ham-Nord Hamilton Hamiota Hammond Hampden Hampstead Hampstead Hampton Hampton Hanley Hanmer Hanna Hanover Hantsport Hant`s Harbour Happy Valley-Goose Bay Harbour Breton Harbour Grace Harbour Main-Chapel Cove-Lakev Hardisty Hare Bay Harewood Harrietsville Harrington Harbour Harris Harriston Harrow Harrowsmith Hartland Hartley Bay Hartney Hastings Havelock Havelock Havre-Aubert Havre-aux-Maisons Havre-St-Pierre Hawarden Hawk Junction Hawkesbury Hawke`s Bay Hay Lakes Hay River Hays Hazelton Hazlet Hearst Heart`s Content Heart`s Delight-Islington Heart`s Desire Heatherton Hebertville Hebertville-Station Hecla Hedley Heinsburg Heisler Hemlo Hemlock Valley Hemmingford Hendrix Lake Henryville Hensall Henvey Inlet First Nation Hepburn Hepworth Herbert Herschel Hespeler Hickman`s Harbour Hickson High Level High Prairie High River Highgate Hilda Hillgrade Hillsborough Hillsburgh Hillview Hines Creek Hinton Hixon Hobbema Hodgeville Holberg Holden Holdfast Holland Holland Landing Holstein Holyrood Honey Harbour Hope Hopedale Hopewell Hornepayne Horsefly Houston Howick Howley Hoyt Hubbards Hudson Hudson Hudson Bay Hudson`s Hope Hughenden Hull Humber Arm South Humboldt Humphrey Hunter River Huntingdon Huntsville Hussar Hythe Iberville Ignace Ilderton Ile-a-la-Crosse Ile-aux-Coudres Iles-de-la-Madeleine Ilford Imperial Indian Head Indian Tickle Ingersoll Ingleside Ingonish Innerkip Innisfail Innisfil Innisfree Inukjuak Inuvik Inverary Invermay Invermere Inverness Inverness Inwood Inwood Iqaluit Irma Iron Bridge Iron Springs Iroquois Iroquois Falls Irricana Irvine Iskut Island Harbour Island Lake Islay Isle aux Morts Ituna Jackson`s Arm Jacquet River Jaffray Jaffray Melick Jamestown Jansen Jarvie Jarvis Jasper Jasper Jean Marie River Jellicoe Jenner Jockvale Joe Batt`s Arm-Barr`d Islands- Johnstown Joliette Jonquiere Jordan Joussard Joutel Kakisa Kaministiquia Kamiskotia Kamloops Kamsack Kananaskis Kanata Kangiqsualujjuaq Kangirsuk Kapuskasing Kasabonika First Nation Kashechewan First Nation Kaslo Kateville Kazabazua Kearney Kedgwick Keene Keephills Keewatin Keg River Kelliher Kelowna Kelvington Kelwood Kemano Kemptville Kenaston Kennedy Kennetcook Kenora Kenosee Kensington Kent Centre Kenton Kentville Kenzieville Keremeos Kerrobert Kerwood Keswick Keswick Ketch Harbour Key Lake Killaloe Killam Killarney Killarney Kimberley Kincaid Kincardine Kincolith Kindersley King City Kingfisher Lake Kingfisher Lake First Nation Kingsbury Kingsey Falls Kingston Kingsville King`s Cove King`s Point Kinistino Kinmount Kintore Kinuso Kipling Kippens Kirkfield Kirkland Kirkland Lake Kirkton Kisbey Kitchener Kitimat Kitkatla Kitsault Kitscoty Kitwanga Kleinburg Klemtu Knowlton Kugluktuk Kuujjuaq Kyle Kyuquot La Baie La Broquerie La Corne La Crete La Dore La Grande La Guadeloupe La Loche La Malbaie La Martre La Minerve La Patrie La Plaine La Pocatiere La Prairie La Reine La Romaine La Ronge La Sarre La Scie La Tuque Labelle Labrador City Lac Brochet Lac du Bonnet Lac Kenogami Lac La Biche Lac la Croix Lac la Hache Lac Seul First Nation Lac-au-Saumon Lac-aux-Sables Lac-Bouchette Lac-Brome Lac-Delage Lac-des-Ecorces Lac-Drolet Lac-du-Cerf Lac-Edouard Lac-Etchemin Lac-Frontiere Lac-Poulin Lac-Saguay Lac-Sergent Lac-St-Joseph Lachenaie Lachine Lachute Lacolle Lacombe Ladle Cove Ladysmith Lafleche Lafontaine Lafontaine Lagoon City LaHave Laird Lake Alma Lake Charlotte Lake Cowichan Lake Lenore Lake Louise Lake Megantic Lakefield Lamaline Lambeth Lambton Lameque Lamont Lampman Lanark Lancaster Landis Lang Langara Langdon Langenburg Langham Langley Langruth Langton Lanigan Lanoraie Lansdowne Lansdowne House Lantzville Larder Lake Lark Harbour Larrys River LaSalle LaSalle Lashburn Latchford Laterriere Latulipe Laurentides Laurier-Station Laurierville Laval Laval des Rapides Laval Ouest Lavaltrie Laverlochere Lavoy Lawn Lawrencetown Lawrenceville Le Bic Le Gardeur Leader Leaf Rapids Leamington Leask Lebel-sur-Quevillon Leclercville Leduc Lefroy Legal Lemberg LeMoyne Lennoxville Leoville Leroy Lery Les Boules Les Cedres Les Coteaux Les Eboulements Les Escoumins Les Mechins Leslieville Lestock Lethbridge Levack Levis Lewisporte Libau Liberty Likely Lillooet Limerick Lincoln Lindsay Lintlaw Linwood Lion`s Head Lipton Listowel Little Bay Little Bay Islands Little Britain Little Burnt Bay Little Catalina Little Current Little Fort Little Grand Rapids Little Heart`s Ease Lively Liverpool Lloydminster Lloydminster Lockeport Lockport Lodgepole Logan Lake Logy Bay-Middle Cove-Outer Cov Lombardy Lomond London Long Harbour-Mount Arlington H Long Lac Long Lake First Nation Long Point Long Pond Long Sault Longlac Longueuil Longview Loon Lake Loos Loreburn Loretteville Lorne Lorraine Lorrainville Lougheed Louisbourg Louisdale Louiseville Lourdes Lourdes de Blanc Sablon Louvicourt Low Lower Island Cove Lower Post Lucan Luceville Lucknow Lucky Lake Lumby Lumsden Lumsden Lundar Lunenburg Luseland Luskville Lyn Lynden Lynn Lake Lyster Lytton L`Acadie L`Ancienne-Lorette L`Ange-Gardien L`Annonciation L`Anse-au-Loup L`Ardoise L`Assomption L`Avenir L`Epiphanie L`Ile-Aux-Noix L`Ile-Bizard L`Ile-Cadieux L`Ile-Dorval L`Ile-d`Entree L`Ile-Perrot L`?le-Verte L`Islet L`Orignal Ma-Me-O Beach Maberly Mabou Macamic Maccan Macdiarmid Maces Bay MacGregor Mackenzie Macklin Macrorie MacTier Madoc Madsen Mafeking Magnetawan Magnetawan First Nation Magog Magrath Mahone Bay Maidstone Maidstone Main Brook Maitland Maitland Makkovik Malartic Mallorytown Malton Manic-Cinq Manigotagan Manitou Manitouwadge Manitowaning Maniwaki Mankota Manning Mannville Manor Manotick Manouane Manseau Mansonville Manyberries Maple Maple Creek Maple Grove Maple Ridge Marathon Marcelin Margaree Forks Margo Maria Marieville Marion Bridge Markdale Markham Markstay Marlboro Marmora Marquis Marsden Marsh Lake Marshall Marsoui Marten Falls First Nation Marten River Martensville Martintown Marwayne Maryfield Marystown Mary`s Harbour Mascouche Maskinonge Masset Massey Massey Drive Masson-Angers Massueville Mastigouche Matachewan Matagami Matane Matapedia Matheson Mattawa Mattice Maxville Mayerthorpe Maymont Maynooth Mayo McAdam McAuley McBride McCreary McDonalds Corners McGregor McIver`s McKellar McLeese Lake McLennan McLeod Lake Mcmasterville Meacham Meadow Lake Meaford Meander River Meath Park Medicine Hat Meductic Melbourne Melbourne Melfort Melita Mellin Melocheville Melrose Melville Memramcook Meota Mercier Merigomish Merlin Merrickville Merritt Metabetchouan Metcalfe Meteghan Metis-sur-Mer Miami Mica Creek Midale Middle Lake Middleton Midland Midway Milden Mildmay Milestone Milford Bay Milk River Millbrook Millertown Millet Millhaven Milltown-Head of Bay D`Espoir Millville Milo Milton Milverton Minaki Minburn Mindemoya Minden Mine Centre Ming`s Bight Miniota Minnedosa Minto Minto Minton Mirabel Miramichi Mirror Miscou Island Missanabie Mission Mississauga Mistassini Mistatim Mitchell Mohawks Of The Bay of Quinte F Moisie Molanosa Monastery Moncton Monkstown Monkton Mont Bechervaise Mont St Gr?goire Mont-Joli Mont-Laurier Mont-Louis Mont-Rolland Mont-Royal Mont-St-Hilaire Mont-St-Pierre Mont-Tremblant Montague Montebello Montmagny Montmartre Montney Montreal Montreal - Est Montr?al - Nord Montr?al - Ouest Moonbeam Moonstone Mooretown Moose Creek Moose Factory Moose Jaw Moose Lake Moosomin Moosonee Morden Morell Morin-Heights Morinville Morley Morrin Morris Morrisburg Morse Morson Mortlach Mossbank Mount Albert Mount Brydges Mount Carmel-Mitchells Brook-S Mount Forest Mount Hope Mount Moriah Mount Pearl Mount Pleasant Mount Stewart Mount Uniacke Moyie Mulgrave Mulhurst Muncho Lake Mundare Murdochville Murray River Musgrave Harbour Musgravetown Muskoka Muskoka Falls Muskrat Dam Muskrat Dam First Nation Musquodoboit Harbour Mutton Bay Myrnam M`Chigeeng Nackawic Nahanni Butte Naicam Nain Nairn Naiscoutaing First Nation Nakina Nakusp Namao Nampa Nanaimo Nantes Nanticoke Nanton Napanee Napierville Naramata Natashquan Navan Nedelec Neepawa Neguac Neidpath Neilburg Nelson Nelson House Nepean Nephton Nestor Falls Neudorf Neustadt Neuville Neville New Aiyansh New Carlisle New Dayton New Denmark New Denver New Dundee New Germany New Glasgow New Glasgow New Hamburg New Harbour New Haven New Liskeard New London New Norway New Perlican New Richmond New Ross New Sarepta New Tecumseth New Waterford New Westminster New-Wes-Valley Newbrook Newburgh Newcastle Newdale Newmarket Newport Newtonville Niagara Falls Niagara-on-the-Lake Nickel Centre Nicolet Nimpo Lake Nipawin Nipigon Nipissing First Nation Nippers Harbour Nisku Niton Junction Niverville Nobel Nobleford Nobleton Noel Noelville Nokomis Norbertville Nordegg Norman Wells Normandin Norman`s Cove-Long Cove Normetal Norquay Norris Arm North Augusta North Battleford North Bay North Gower North Hatley North Portal North Saanich North Spirit Lake North Sydney North Vancouver North West River North York Northbrook Northern Arm Norton Norval Norway House Norwich Norwood Notre Dame de Bonsecours Notre Dame de Lourdes Notre Dame de Lourdes Notre Dame De L`Ile Perrot Notre Dame des Laurentides Notre Dame Des Prairies Notre Dame Du Portage Notre-Dame-de-la-Paix Notre-Dame-de-la-Salette Notre-Dame-de-Stanbridge Notre-Dame-du-Bon-Conseil Notre-Dame-du-Lac Notre-Dame-du-Laus Notre-Dame-du-Nord Nouvelle Oak Lake Oak Ridges Oak River Oakville Oakville Oakwood Oba Ocean Falls Ocean Park Ochre River Odessa Odessa Ogema Ogoki Ohsweken Oil Springs Ojibways of Hiawatha First Nat Ojibways of Walpole Island Fir Oka Okanagan Falls Okotoks Old Crow Old Perlican Olds Oliver Omemee Omerville Onaping Falls Oneida First Nation Onoway Opasatika Ophir Orangeville Orford Orillia Orleans Ormiston Ormstown Oro Oromocto Orono Orrville Osgoode Oshawa Osler Osoyoos Ottawa Otterburn Park Otterville Outlook Outremont Owen Sound Oxbow Oxdrift Oxford Oxford House Oxford Mills Oyama Oyen O`Leary Packs Harbour Pacquet Paddockwood Paisley Pakenham Palgrave Palmarolle Palmer Rapids Palmerston Pangman Papineauville Paquette Corner Paquetville Paradise Paradise Hill Paradise River Paradise Valley Parent Parham Paris Parkhill Parksville Parrsboro Parry Sound Parson Pasadena Pass Lake Patuanak Paynton Peace River Peachland Peawanuck Peerless Lake Peers Pefferlaw Peggy`s Cove Peguis Pelee Island Pelham Pelican Narrows Pelican Rapids Pelly Pelly Crossing Pemberton Pembroke Penetanguishene Penhold Pennant Pense Penticton Perce Perdue Peribonka Perkins Perrault Falls Perth Perth-Andover Petawawa Peterborough Peterview Petit Rocher Petitcodiac Petite-Riviere-St-Francois Petrolia Petty Harbour-Maddox Cove Philipsburg Piapot Pickering Pickle Lake Picton Pictou Picture Butte Pierceland Pierrefonds Pierreville Pikangikum First Nation Pikwitonei Pilot Butte Pilot Mound Pinawa Pincher Creek Pincourt Pine Dock Pine Falls Pine River Pineal Lake Pinehouse Piney Pintendre Pitt Meadows Placentia Plaisance Plamondon Plantagenet Plaster Rock Plate Cove East Plato Plattsville Pleasant Park Plenty Plessisville Plevna Plum Coulee Plumas Pohenegamook Point Grondine First Nation Point Leamington Point Pelee Pointe au Baril Pointe Aux Trembles Pointe du Bois Pointe-a-la-Croix Pointe-au-Pere Pointe-aux-Outardes Pointe-Calumet Pointe-Claire Pointe-des-Cascades Pointe-des-Monts Pointe-Fortune Pointe-Lebel Ponoka Pont-Rouge Pont-Viau Ponteix Pontiac Pool`s Cove Poplar River Poplarfield Porcupine Plain Port Alberni Port Alice Port au Choix Port au Port West-Aguathuna-Fe Port Aux Basques Port Bickerton Port Blandford Port Burwell Port Carling Port Clements Port Colborne Port Coquitlam Port Credit Port Cunnington Port Dover Port Dufferin Port Edward Port Elgin Port Elgin Port Franks Port Greville Port Hardy Port Hawkesbury Port Hood Port Hope Port Hope Simpson Port La Tour Port Lambton Port Loring Port Maitland Port McNeill Port McNicoll Port Mellon Port Moody Port Morien Port Mouton Port Perry Port Renfrew Port Rexton Port Robinson Port Rowan Port Saunders Port Stanley Port Sydney Port Union Port-Cartier Port-Daniel Port-Menier Portage la Prairie Portage-du-Fort Portland Portneuf Portugal Cove-St. Philip`s Poste-de-la-Baleine Postville Pouce Coupe Pouch Cove Powassan Powell River Preeceville Prelate Prescott Prespatou Preston Prevost Price Prince Albert Prince George Prince Rupert Princeton Princeton Princeton Princeville Prophet River Provost Prud`homme Pubnico Puce Pugwash Punnichy Puvirnituq Quadra Island Qualicum Beach Quebec Queen Charlotte Queensport Queenston Queensville Quesnel Quill Lake Quispamsis Quyon Qu`Appelle Rabbit Lake Radisson Radisson Radium Hot Springs Radville Radway Rae Rae Lakes Rainbow Lake Rainy Lake First Nation Rainy River Raith Raleigh Ralston Ramea Ramore Rankin Inlet Rapid City Rathwell Rawdon Raymond Raymore Rayside-Balfour Red Bank Red Bay Red Deer Red Lake Red Rock Red Rock Red Sucker Lake Redbridge Redcliff Redditt Redvers Redwater Reefs Harbour Regina Regina Beach Remigny Rencontre East Renfrew Rennie Repentigny R?serve faunique de Rimouski R?serve faunique la V?rendrye R?serves fauniques de Matane e Resolute Reston Restoule Revelstoke Rhein Riceton Richelieu Richibucto Richmond Richmond Richmond Richmond Hill Richmound Ridgedale Ridgetown Ridgeway Rigaud Rigolet Rimbey Rimouski Rimouski-Est Riondel Ripley Ripon Riske Creek River Hebert River John River of Ponds Riverhurst Riverport Rivers Riverton Riverview Riviere-a-Pierre Riviere-au-Renard Riviere-au-Tonnerre Riviere-Beaudette Riviere-Bleue Riviere-du-Loup Riviere-Heva Riviere-St-Jean Robb Robertsonville Robert`s Arm Roberval Roblin Rocanville Rochebaucourt Rochester Rock Creek Rock Forest Rockglen Rockland Rockwood Rocky Harbour Rocky Mountain House Rockyford Roddickton Rodney Rogersville Roland Rolla Rollet Rolling Hills Rolphton Rondeau Rorketon Rosalind Rose Blanche-Harbour Le Cou Rose Valley Rosebud Rosemere Roseneath Rosetown Ross River Rossburn Rosseau Rossland Rosthern Rothesay Rougemont Rouleau Rouyn-Noranda Roxboro Roxton Falls Roxton Pond Rumsey Rushoon Russell Russell Rusticoville Ruthven Rycroft Ryley Saanich Sabrevois Sachigo First Nation Reserve 1 Sackville Sacre Coeur Saint Alexandre D`Iberville Saint Alphonse de Granby Saint Amable Saint Andrews Saint Antoine Des Laurentides Saint Antoine Sur Richelieu Saint Antonin Saint Athanase Saint Calixte Saint Charles Borromee Saint Charles Sur Richelieu Saint Christophe D`Arthabaska Saint Clair Beach Saint Colomban Saint Denis De Brompton Saint Denis Sur Richelieu Saint Esprit Saint Etienne de Beauharnois Saint Etienne de Lauzon Saint Gerard Majella Saint Isidore de la Prairie Saint Jean Baptiste Saint Jean D`Orleans Saint Joachim Saint John Saint Joseph De La Pointe De L Saint Laurent D`Orleans Saint Lazare De Vaudreuil Saint Lin Laurentides Saint Marc Sur Richelieu Saint Mathias Sur Richelieu Saint Mathieu de Beloeil Saint Mathieu de la Prairie Saint Maurice Saint Norbert D`Arthabaska Saint Paul D`Industrie Saint Philippe Saint Pierre D`Orleans Saint Robert Saint Roch De L`Achigan Saint Roch De Richelieu Saint Sulpice Saint Thomas Saint Urbain Premier Saint Valere Saint Victoire de Sorel Saint-Alexis-de-Montcalm Saint-C?me Saint-Donat Saint-?lie Saint-?lie-d`Orford Saint-Ferdinand Saint-Ferr?ol-les-neiges Saint-Hubert Saint-Hyacinthe Saint-Michel-des-Saints Sainte Angele De Monnoir Sainte Ann De Sorel Sainte Brigide D`Iberville Sainte Cecile De Milton Sainte Dorothe? Sainte Famille Sainte Marie Salome Sainte Marthe Du Cap Sainte Sophie Sainte Therese De Blainville Salaberry-de-Valleyfield Salem Salisbury Salluit Salmo Salmon Arm Salmon Cove Salmon Valley Salt Springs Saltcoats Salvage Sandspit Sandwich Sandy Bay Sandy Cove Acres Sandy Lake Sandy Lake Sandy Lake First Nation Sanford Sangudo Sanmaur Sapawe Sarnia Saskatchewan River Crossing Saskatoon Sauble Beach Saugeen First Nation Saulnierville Sault Ste Marie Sault-au-Mouton Savant Lake Savona Sawyerville Sayabec Sayward Scarborough Sceptre Schefferville Schomberg Schreiber Schuler Scotland Scotstown Scott Seaforth Seal Cove Searchmont Seba Beach Sebright Sebringville Sechelt Sedgewick Sedley Seeleys Bay Selby Seldom-Little Seldom Selkirk Selkirk Semans Senneterre Senneville Sept-Iles Serpent River First Nation Seven Persons Severn Bridge Sexsmith Shakespeare Shalalth Shamattawa Shannonville Sharbot Lake Shaunavon Shawanaga First Nation Shawbridge Shawinigan Shawinigan-Sud Shawville Shebandowan Shedden Shediac Shefford Sheho Shelburne Shelburne Shell Lake Shellbrook Sherbrooke Sherbrooke Sherwood Park Shigawake Shilo Shippagan Shipshaw Shoal Lake Shubenacadie Sibbald Sicamous Sidney Sidney Sifton Sillery Silver Valley Silver Water Simcoe Simpson Sintaluta Sioux Lookout Sioux Narrows Six Nations of the Grand River Skookumchuck Slave Lake Slocan Small Point-Broad Cove-Blackhe Smeaton Smiley Smith Smithers Smiths Falls Smithville Smoky Lake Smooth Rock Falls Snelgrove Snow Lake Snowflake Sointula Sombra Somerset Sooke Sorel-Tracy Sorrento Souris Souris South Brook South Indian Lake South Lake South Mountain South River South River South Slocan Southampton Southampton Southend Southern Harbour Southey Spalding Spaniard`s Bay Spanish Sparta Sparwood Speers Spencerville Spences Bridge Sperling Spillimacheen Spirit River Spiritwood Split Lake Spotted Island Sprague Springdale Springfield Springfield Springhill Springside Spruce Grove Spruce View Sprucedale Spy Hill Squamish Squatec St-Adelphe St-Adolphe-de-Dudswell St-Adolphe-d`Howard St-Agapit St-Aime St-Albert St-Alexandre-de-Kamouraska St-Alexis-de-Matapedia St-Alexis-des-Monts St-Alphonse-Rodriguez St-Andre St-Andre-Avellin St-Andre-du-Lac-St-Jean St-Andre-Est St-Anselme St-Antoine St-Antoine St-Antoine-de-Tilly St-Apollinaire St-Augustin-de-Desmaures St-Barnabe St-Barthelemy St-Basile St-Basile-le-Grand St-Basile-Sud St-Blaise-sur-Richelieu St-Boniface-de-Shawinigan St-Bruno St-Bruno-de-Montarville St-Calixte-de-Kilkenny St-Casimir St-Celestin St-Cesaire St-Charles-de-Bellechasse St-Chrysostome St-Clet St-Constant St-Cyrille-de-Wendover St-Damase St-Damien-de-Buckland St-Denis St-Edouard-de-Lotbiniere St-Eleuthere St-Emile St-Emile-de-Suffolk St-Ephrem-de-Beauce St-Ephrem-de-Tring St-Eugene St-Eugene-de-Guigues St-Eustache St-Fabien-de-Panet St-Felicien St-Felix-de-Kingsey St-Felix-de-Valois St-Fidele-de-Mont-Murray St-Flavien St-Francois-du-Lac St-Fulgence St-Gabriel St-Gabriel-de-Brandon St-Gedeon St-Georges St-Georges-de-Beauce St-Georges-de-Cacouna St-Gerard St-Germain-de-Grantham St-Gregoire-de-Greenlay St-Guillaume St-Hilarion St-Hippolyte St-Honore-de-Beauce St-Honore-de-Chicoutimi St-Hugues St-Irenee St-Isidore St-Jacques St-Jean-Chrysostome St-Jean-de-Dieu St-Jean-de-Matha St-Jean-Port-Joli St-Jean-sur-Richelieu St-Jerome St-Joseph-de-Beauce St-Joseph-de-la-Rive St-Joseph-de-Sorel St-Jovite St-Jude St-Just-de-Bretenieres St-Lambert St-Lambert-de-Lauzon St-Laurent St-Leon-le-Grand St-Leonard St-Leonard-d`Aston St-Liboire St-Lin St-Louis de Kent St-Louis-de-France St-Luc St-Ludger St-Magloire St-Malachie St-Malo St-Marc-des-Carrieres St-Methode-de-Frontenac St-Michel-de-Bellechasse St-Moose St-Nazaire-d`Acton St-Nicolas St-Noel St-Odilon-de-Cranbourne St-Ours St-Pacome St-Pamphile St-Pascal St-Patrice-de-Beaurivage St-Paul-de-Montminy St-Paul-d`Abbotsford St-Paulin St-Philippe-de-Neri St-Pie St-Pie-de-Guire St-Pierre St-Pierre-de-Wakefield St-Pierre-Jolys St-Pierre-les-Becquets St-Polycarpe St-Prime St-Prosper-de-Dorchester St-Quentin St-Raymond St-Redempteur St-Remi St-Rene-de-Matane St-Roch-de-Mekinac St-Roch-des-Aulnaies St-Romuald St-Sauveur St-Sauveur-des-Monts St-Simeon St-Simon-de-Bagot St-Simon-de-Rimouski St-Sylvere St-Sylvestre St-Theophile St-Thomas-d`Aquin St-Timothee St-Tite St-Tite-des-Caps St-Ubalde St-Ulric St-Urbain St-Victor St-Wenceslas St-Zacharie St-Zenon St-Zephirin St-Zotique St. Alban`s St Albert St. Ambroise de Chicoutimi St. Anthony St. Basile de Portneuf St. Benedict St. Bernard de Dorchester St. Bernard`s-Jacques Fontaine St. Brendan`s St. Bride`s St. Brieux St Catharines St. Charles St. Claude St. Clements St. Come de Kennebec St. Davids St. Edouard de Frampton St. Fabien de Rimouski St. Ferdinand d`Halifax St. Fidele St. Francois Xavier St. Gabriel de Rimouski St. Gedeon de Beauce St. George St. George St. George`s St. Gregoire de Nicolet St. Gregor St. Henri de Levis St. Honore St. Isidore de Prescott St. Jacobs St. Jacques-Coomb`s Cove St. Jean Baptiste St. John`s St. Laurent St. Lawrence St. Lazare St. Leon De Chic. St. Leonard St. Lewis St. Louis St. Lunaire-Griquet St. Margaret Village St. Martin de Beauce St. Martins St. Marys St. Mary`s St. Michael St. Moise St. Paul St. Peters St. Peter`s St. Raphael de Bellechasse St. Regis St. Sebastien St. Stanislas de Champlain St. Stephen St. Theodore de Chertsey St. Thomas St. Victor de Beauce St. Vincent de Paul St. Vincent`s-St. Stephen`s-Pe St. Walburg Stand Off Standard Stanley Stanley Mission Stanstead Star City Starbuck Stavely Stayner Ste-Adele Ste-Agathe Ste-Agathe-des-Monts Ste-Agathe-Sud Ste-Anne-de-Beaupre Ste-Anne-de-Bellevue Ste-Anne-de-la-Perade Ste-Anne-de-Madawaska Ste-Anne-de-Portneuf Ste-Anne-des-Monts Ste-Anne-des-Plaines Ste-Anne-du-Lac Ste-Blandine Ste-Brigitte-de-Laval Ste-Catherine Ste-Clotilde-de-Horton Ste-Eulalie Ste-Felicite Ste-Foy Ste-Genevieve Ste-Helene-de-Bagot Ste-Henedine Ste-Jeanne-d`Arc Ste-Julie Ste-Julie-de-Vercheres Ste-Julienne Ste-Justine Ste-Lucie-de-Beauregard Ste-Madeleine Ste-Marguerite Ste-Marie-de-Beauce Ste-Marie-de-Blandford Ste-Marthe Ste-Marthe-sur-le-Lac Ste-Perpetue Ste-Petronille Ste-Rosalie Ste-Rose Ste-Rose-de-Watford Ste-Rose-du-Nord Ste-Sophie-de-Levrard Ste-Thecle Ste-Therese Ste-Veronique Ste-Victoire Ste. Agathe Ste. Agathe de Lotbiniere Ste. Angele de Laval Ste. Cecile Masham Ste. Claire de Dorchester Ste. Croix de Lotbiniere Ste. Gertrude Ste. Justine de Newton Ste. Martine Ste. Methode de Frontenac Ste. Monique de Nicolet Ste. Rose du Lac Steady Brook Steep Rock Steinbach Stellarton Stephenville Stephenville Crossing Stettler Stevensville Stewart Stewarttown Stewiacke Stirling Stirling Stockholm Stoke Stoke`s Bay Stoneham Stonewall Stoney Creek Stoney Point Stony Plain Stony Rapids Storthoaks Stouffville Stoughton Straffordville Strasbourg Stratford Stratford Stratford Strathclair Strathmore Strathroy Stratton Streetsville Strome Strongfield Stroud Stukely-Sud Sturgeon Falls Sturgis Sudbury Sultan Summer Beaver Summerford Summerland Summerside Summerside Summerville Summit Lake Sunderland Sundre Sundridge Sunnyside Surrey Sussex Sutton Sutton Swan Hills Swan Lake Swan River Swastika Swift Current Swift River Sydenham Sydney Sylvan Lake Taber Tabusintac Tachie Tadoule Lake Tadoussac Tagish Tahsis Tamworth Tangier Tantallon Tara Taschereau Tasiujaq Tatamagouche Tatla Lake Tavistock Taylor Taylor Corners Tecumseh Teeswater Telegraph Creek Telkwa Temagami Temiscaming Terra Nova Terrace Terrace Bay Terrasse Vaudreuil Terrebonne Terrenceville Teslin Tete-a-la-Baleine Teulon Thamesford Thamesville The Eabametoong (Fort Hope) Fi The Pas Thedford Theodore Thessalon Thessalon First Nation Thetford Mines Thicket Portage Thompson Thorburn Thorhild Thornbury Thorndale Thorne Thornhill Thorold Thorsby Three Hills Thrums Thunder Bay Thurlow Thurso Tignish Tilbury Tilley Tillsonburg Timmins Tingwick Tisdale Tiverton Toad River Tobermory Tobique First Nation Tofield Tofino Togo Toledo Tomahawk Tompkins Topley Torbay Toronto Toronto Island Torquay Torrington Tottenham Tracadie-Sheila Trail Tramping Lake Treherne Tremblay Trenton Trenton Trepassey Tribune Tring-Jonction Triton Trochu Trois-Pistoles Trois-Rivieres Trout Creek Trout Lake Trout Lake Trout Lake Trout River Trowbridge Truro Tsay Keh Dene Tsiigehtchic Tuktoyaktuk Tumbler Ridge Turner Valley Turnor Lake Turtleford Tusket Tweed Twillingate Two Hills Tyne Valley Ucluelet Udora Umiujaq Uniondale Unionville Unity Upper Island Cove Upper Musquodoboit Upper Stewiacke Upsala Upton Uranium City Utterson Uxbridge Val Marie Val-Alain Val-Barrette Val-Belair Val-Brillant Val-David Val-des-Bois Val-d`Or Valcartier Valcourt Valemount Vallee-Jonction Valley East Valleyview Vallican Van Anda Vancouver Vanderhoof Vanguard Vanier Vanier Vankleek Hill Vanscoy Varennes Vaudreuil Vaudreuil Dorion Vaudreuil-sur-le-Lac Vaughan Vauxhall Vavenby Vegreville Venise-en-Quebec Vercheres Verdun Vermilion Vermilion Bay Verner Vernon Vernon River Verona Veteran Vibank Victoria Victoria Victoria Victoriaville View Royal Viking Ville-Marie Vilna Vimont Vineland Virden Virginiatown Viscount Vita Vonda Vulcan Waasagomach Wabamun Wabana Wabigoon Wabowden Wabush Wadena Wainfleet Wainwright Wakaw Wakefield Walden Waldheim Walkerton Wallace Wallaceburg Walsh Walton Wandering River Wanham Wanless Wapekeka First Nation Wapella Warburg Warden Wardsville Warkworth Warman Warner Warren Warspite Warwick Wasaga Beach Wasagaming Waskaganish Waskatenau Waskesiu Lake Waswanipi Waterdown Waterford Waterhen Waterloo Waterville Watford Watrous Watson Watson Lake Waubaushene Waverley Wawa Wawanesa Wawota Webb Webbwood Webequie Wedgeport Weedon Weedon Centre Welcome Welland Wellandport Wellesley Wellington Wellington Wells Welsford Welwyn Wembley Wemindji Wendover Wesleyville West Brome West Guilford West Lincoln West Lorne West Vancouver Westbank Westbury Western Bay Westfield Westlock Westmeath Westmount Westport Westport Westree Westville Westwold Wetaskiwin Weyburn Weymouth Whale Cove Wheatley Whistler Whitbourne Whitby Whitchurch-Stouffville White Fox White River White Rock Whitecourt Whitefish Whitefish Falls Whitefish River First Nation Whitehorse Whitelaw Whitemouth Whitewood Whitney Whycocomagh Wiarton Wickham Widewater Wikwemikong Wilberforce Wilcox Wildwood Wilkie Williams Lake Williamsburg Willingdon Willow Bunch Willowbrook Winchester Windermere Windsor Windthorst Winfield Winfield Wingham Winkler Winnipeg Winnipeg Beach Winnipegosis Winona Winter Harbour Winterton Wiseton Wishart Witless Bay Woburn Woking Wolfville Wollaston Lake Wolseley Wonowon Wood Mountain Woodbridge Woodridge Woodstock Woodstock Woodville Woody Point Wooler Worsley Wotton Wrentham Wrigley Wunnummin Lake Wynndel Wynyard Wyoming Yahk Yale Yamachiche Yamaska Yamaska-Est Yarker Yarmouth Yellow Creek Yellow Grass Yellowknife York Yorkton Youbou Young Youngstown Young`s Cove Road Zealandia Zeballos Zenon Park Zurich Kawartha Lakes Strathcona County Wood Buffalo Brant Clarence Rockland Dryden Elliot Lake Greater Sudbury Haldimand County Kenora Norfolk County Orillia Owen Sound Pembroke Port Colborne Prince Edward County Quinte West St. Thomas Temiskaming Shores Timmins Bowmanville Huntsville Brockville

Please Select

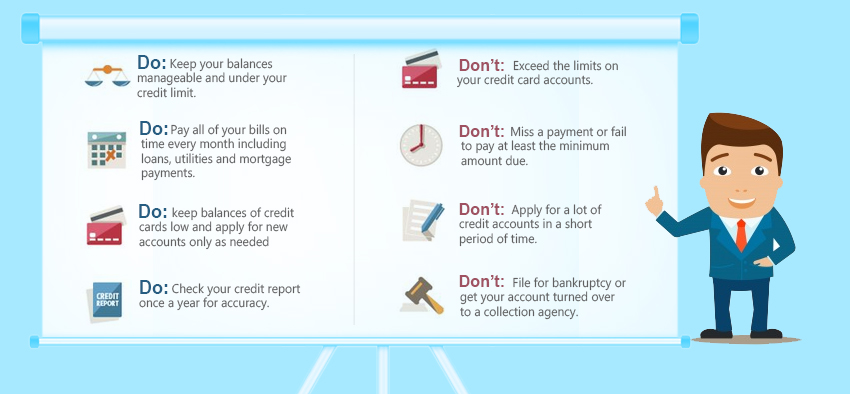

Buying

Renew Mortgage

Debt Consolidation

Refinancing

Submit Now