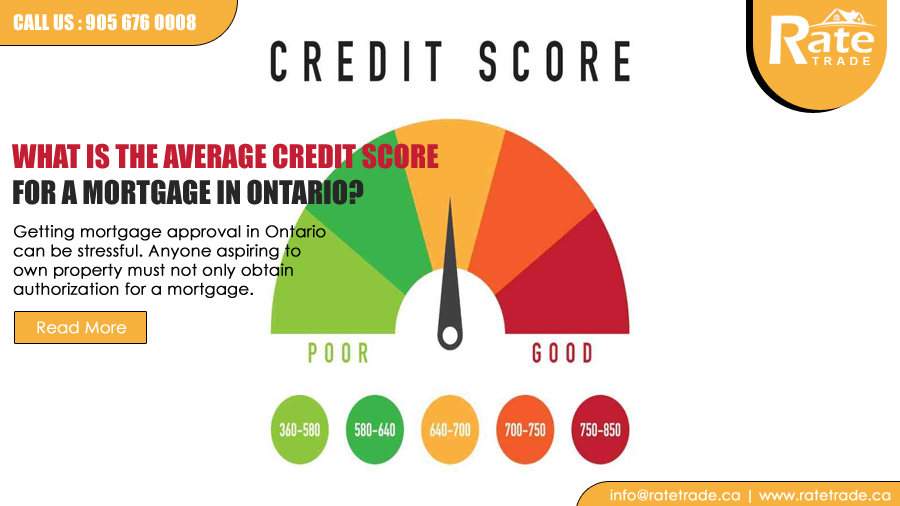

Getting mortgage approval in Ontario can be stressful. Anyone aspiring to own property must not only obtain authorization for a mortgage but also comply with ever-stricter mortgage approval requirements because housing …

A mortgage is an arrangement in which a person provides or keeps their immovable property as security for a loan. A mortgage lender or a bank generally provides this type of loan. But the loan should be paid back on …

Before getting into the rights of mortgage, we should be familiar with some peculiar terms related to the mortgage, such as. A mortgagor is a person who has transferred the immovable property in exchange for …

Lenders can decide whether or not to approve a home loan application based on the borrower’s income. It says a lot about your ability to pay back the mortgage; the higher your income, the larger your ability to pay back …

The reigned for generations. People love it for its affordability as well as predictability. A 30-year mortgage is a full amortizable loan, meaning it is combined with interest and principal. The full amount is paid …

Mortgage brokers usually offer the most significant default insurance rates for clients with less than a 20% down payment. Banks typically offer the best-uninsured rates, particularly for borrowers who put down less …

The mortgage stress test is required of all homebuyers. If interest rates rise and mortgage payments increase dramatically, the mortgage stress test can help you avoid defaulting on your loan. There are steps you can …

If you think about how you will be approved for a mortgage with a low income, this page will walk you through what you need to know about it. You can get a mortgage even if you have a lower …

Buying a house is one of life’s most stressful events. It’s crucial to comprehend the stages of purchasing a home to make things easier. Closing fees are an issue that you’ll have to deal with. Closing costs, such as …

To understand a fixed-rate mortgage, we should know what a mortgage is? A mortgage, in simple terms, is the loan that a person uses to buy a home or land. That person becomes the borrower and agrees to pay the …